The millennial generation has grown up in an era dominated by rapid changes in the economy. In recent decades, the responsibility of saving and investing has been largely delegated to individuals, as opposed to previous generations where this was mainly the role of governments and employers. Improved standards of living have also translated to increased life expectancies among millennials. The implication of this is that young people today have to make sound financial decisions to achieve financial security in retirement.

2 min read

How Millennials Can Plan for the Future with a Financial Advisor

By NAIFA on 7/15/22 10:00 AM

Topics: Retirement Planning Financial Planning Planning in Advance Retirement Legacy Planning Tools Financial Literacy Retirement Plans Financial Security

1 min read

Bank Account Bonus Month

By National Today on 7/1/22 3:55 PM

This month is Bank Account Bonus Month! If you haven't started a bank account, this is the month to do so.

Topics: Finance Financial Security

5 min read

Reverse Mortgages: No Longer Just a Loan of Last Resort

By Fairway Independent Mortgage Corp. on 6/24/22 10:00 AM

Many people have very strong opinions on reverse mortgage loans. Frequently, those opinions are based on misconceptions about what reverse mortgages are and how they work. One such fallacy that continues to live on is that reverse mortgages are just a loan of last resort—something that’s only for cash-strapped homeowners to utilize when all other viable solutions have been exhausted.

In a recent New York Times article titled Reverse Mortgages Are No Longer Just for Homeowners Short on Cash, the author writes: “It was conventional wisdom that a reverse mortgage was a last-resort option for the oldest homeowners who desperately needed cash. But a growing number of researchers say these loans could be a good option for people earlier in their retirement […] who are not needy at all.”

Topics: Retirement Planning Financial Planning Planning in Advance Lifestyle Planning Reverse Mortgages Loan Financial Security

6 min read

The Do’s and Don’ts of Achieving Financial Freedom

By EveryIncome on 6/6/22 11:00 AM

We all want to be financially free, right? Living under the burden of bills, saving, and trying to figure life out feels impossible and overwhelming at times. What if we told you that achieving financial freedom is within your reach – you just have to know the do’s and don’ts of handling your personal finances.

Here’s what you should know.

Topics: Financial Planning Lifestyle Planning Financial Wellness Financial Literacy Financial Security Budgeting

5 min read

What Is an Appraisal and How Does It Affect Homebuyers?

By EveryIncome on 6/3/22 10:00 AM

When you buy a home, the lender will require an appraisal. It sounds scary and like it could stop you from getting the loan you need or the home you want. While an appraisal can be a stumbling block when you’re trying to buy a home, it’s there to protect you and the lender. Understanding the appraisal, how it works, and what your options are if the appraisal doesn’t come in high enough is important.

Topics: Financial Planning Planning in Advance Financial Security

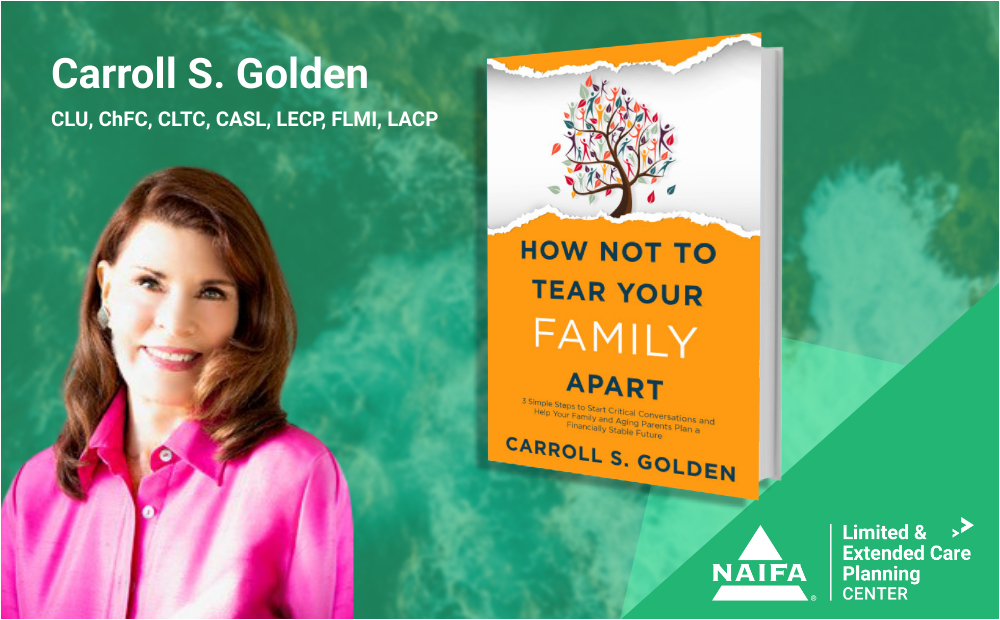

How Not To Tear Your Family Apart: 20 Years from Now

By Carroll Golden on 5/4/22 11:00 AM

"A lack of planning has immediate consequences and possibly consequences that will reach 20 years into the future," says Golden in her new book, "How Not to Tear Your Family Apart". Golden has been bringing the concept to both financial advisors and consumers that we need to get the conversation started far sooner than anyone expects so that dire consequences do not occur that possibly impacts generations to come.

Topics: Limited & Extended Care Planning Center Financial Security

2 min read

3 Most Common Medical Debt Mistakes

By EveryIncome on 4/22/22 1:30 PM

Each year, many Americans struggle to manage their medical expenses. Routine healthcare procedures can be expensive enough, but there are even more significant costs associated with emergency medical care, chronic illness management, and childbirth. Too many Americans are finding themselves drowning in the medical debt they’ve accrued from essential treatment and medication, with or without health insurance. Three major mistakes can cause patients to rack up more significant medical debt than is necessary, but fortunately, these strategies can help.

Topics: Financial Planning Financial Literacy Financial Security Debt Medical

1 min read

How to Prepare Financially for Natural Disasters

By NAIFA on 3/7/22 9:00 AM

Natural disasters such as hurricanes, wildfires, floods, tornadoes, and earthquakes can paralyze your finances when they strike. Unfortunately, many people fail to prepare financially and are caught unaware when natural disasters hit.

Here are two ways to prepare financially in the event of a natural disaster.

Topics: Financial Security Emergency Savings

2 min read

No Heirs? Why You Still Need to Have an Estate Plan

By EveryIncome on 2/25/22 2:00 PM

Having no heirs doesn’t absolve you from the need for proper estate planning.

The most avoidable problem is what happens to your wealth if you die without making a will (or dying intestate). When this happens, the state court system decides how to handle your money and belongings.

Therefore, whether you have no heirs or a hundred, the most important element of estate planning remains unchanged: Make a plan. Even a flawed plan is better than none, so consider tackling this task as soon as possible.

Topics: Financial Planning Estate Planning Financial Literacy Financial Security

3 min read

How to Become Debt-Free on a Low Salary

By EveryIncome on 12/31/21 8:00 AM

Being in debt is stressful, especially if you’re on a salary that barely covers your other regular expenses. However, it is possible to get out of debt on a low salary.

Just like any other trying financial situation, becoming debt-free with a smaller income requires focus, persistence, patience, and the ability to be honest with yourself.