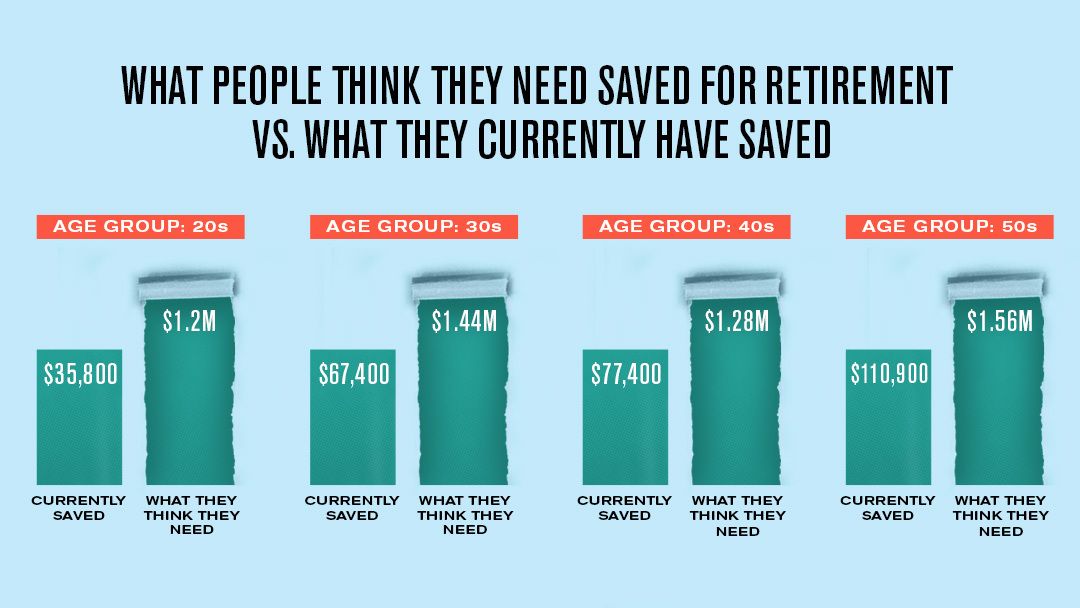

Americans think they’ll need $1.27 million dollars for retirement. They report having less than $90,000 on average in retirement savings. Those are the results of the 2023 Northwestern Mutual Planning & Progress study.

“The good news is that Americans are saving and investing more for tomorrow, even in this time of high inflation and market volatility,” says Aditi Javeri Gokhale, chief strategy officer, president of retail investments and head of institutional investments at Northwestern Mutual. “That’s a step in the right direction and a reverse of what we saw last year when the gap widened rather than narrowed. The challenging news is that there continues to be a big disparity between what they think they’ll need to retire and what they’ve saved to date.”

Below, we have some tips on how you can get a jump on your savings and how to maximize the dollars you’re putting away.

Average Retirement Savings by Age

2023 Northwestern Mutual Planning & Progress Study

2023 Northwestern Mutual Planning & Progress Study

How Much Do I Need in Retirement Savings?

So how do you stack up with the average? Perhaps a little ahead—or maybe a bit behind? The reality is that it doesn’t really matter. That’s because the amount you need to save is unique to you. Here are a few considerations to help you figure out what your retirement might cost.

What do you want to do in retirement?

Once you no longer have to show up for work every day, how do you envision spending your time? Do you want to travel the world? Perhaps you’re more of a homebody who dreams of providing daycare for your grandkids (just so you can see them every day). Those two visions of retirement (and everything in between) come with very different price tags. It’s OK if you don’t have this completely nailed down, especially if you’re younger. But you know yourself best. Give this one some thought and if you have a spouse or partner, have this conversation together.

If your vision includes grand vacations, you probably need to set more aside. If the idea of peace and quiet at home sounds like heaven to you, you might be in a position to spend more now.

When do you plan to retire?

Are you the type of person who can’t wait to leave work behind? Or do you love your job and could see yourself working forever? Working longer means you’ll have more time to save; plus, the savings you already have will have more time to grow. You’ll also have fewer years that you’ll need to rely on that savings for your paycheck in retirement. That means that on a yearly basis, you may have to save less. If you want to retire sooner, it’s probably no surprise that you’ll want to save more.

How long will you live?

No one knows the answer to this question. But the reality is that if you’re in poor health and don’t expect to live as long, you may not need as much in savings as someone who is in great health. But it’s always a good idea to plan for the risk that you will live longer than you think. More on that below.

How to maximize your retirement savings

When you think about saving for retirement, it may seem like a simple calculus: save as much as possible. But the reality is that how and where you save can be just as important, if not more important, than how much you save. That’s because different financial vehicles behave differently and are even taxed differently. Diversifying your savings among a range of financial options can help you minimize the impact of things like taxes, market volatility, inflation and even the risk that you live longer than expected.

How to use a range of retirement savings options to help you minimize risks

Traditional 401(k) or IRA: These accounts allow you to save for retirement without paying taxes today on the money you save. You also won’t owe any tax on these accounts as their value grows, which helps you build your nest egg even in retirement. However, you will owe tax when you withdraw money from the accounts in retirement. And you will eventually be required to withdraw this money and pay taxes on it.

Your 401(k) or similar accounts can help protect against inflation. Because these accounts typically include market-based investments and get favorable tax treatment, they can help your money grow over time and will help protect you from inflation.

Roth accounts: Roth accounts are offered as IRAs or 401(k)s, but they are taxed differently. You’ll pay tax today on funds you contribute but generally will not pay taxes on the contributions again.

Your Roth account helps hedge against taxes and inflation. The investments in your Roth account have the potential to continue to grow, helping to protect against inflation, and distributions are typically tax-free (after you turn 59 ½). Using a mix of Roth and traditional accounts can help you manage your taxes, both as you’re saving for retirement and when you withdraw funds in retirement. For instance, you might withdraw funds from your traditional accounts right up until you're about to cross into a higher tax bracket. Then you could withdraw the rest of what you need in a given year from your Roth account—tax-free.

Traditional investments: These could be investments over and above what you have contributed to tax-advantaged accounts like 401(k)s and Roths. While 401(k)s and Roths have rules about how much you can contribute and when you can use your savings, there are no such rules with traditional investments, which can make them more flexible.

Traditional investments help hedge against inflation. On any given day, markets are volatile. But over time, stocks, bonds and other investments have the potential to provide long-term growth. That’s important to a retirement plan because you’ll want to give yourself a raise over the course of what could be a 20- or 30-year retirement. Investments can help you keep up as prices rise over time.

Whole life insurance: When you’re saving for retirement, it’s common to have a need for a death benefit to protect your family. Whole life insurance can help cover this need, while also allowing you to accumulate cash value that can become an important part of your retirement plan. That’s because the cash value is guaranteed to grow and is unaffected by the markets.

Whole life insurance provides a legacy and can help protect against market volatility. Your accumulated value is essentially like another cash reserve (that’s likely to grow more than money sitting in a checking account) because you can access it during down markets. In addition, the death benefit will allow you to be more deliberate about your legacy.

Guaranteed income: This is money from Social Security, pensions or income annuities. We call it guaranteed because in retirement, it comes to you on a regular basis no matter how long you live and it is unaffected by the market. Typically, in retirement it’s a good idea to have enough guaranteed income to cover essential expenses like food, utilities or other recurring bills. While you could put money into an annuity when you’re young, this is typically a financial product that people consider as they approach retirement.

Guaranteed income protects against longevity risk and market volatility. Guaranteed income won’t be affected by market volatility and it helps protect you from running out of money in retirement should you live longer than you expect.

Building your retirement savings plan

While this may seem like a lot, the good news is that you don’t have to do it on your own. A Northwestern Mutual financial advisor can get to know you, helping you to prioritize what’s most important for your retirement. Your advisor can then help you build a plan that can give you the confidence that you’ll be able to reach your retirement goals.

This publication is not intended as tax advice. Financial Representatives do not render tax advice. Consult with a tax professional for legal or tax advice that is specific to your situation.

All investments carry some level of risk, including loss of principal invested.

The primary purpose of permanent life insurance is to provide a death benefit. Using permanent life insurance cash value to supplement retirement income will reduce the death benefit and may affect other aspects of the policy.

This article is provided by Northwestern Mutual. Learn more about saving for retirement from a licensed financial advisor using our one-of-a-kind Find An Advisor tool.